Abstract

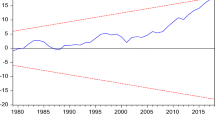

As a fossil-fuel dependent economy, the United States of America relies heavily on crude oil and natural gas. Fluctuations in crude oil and natural gas prices can have a profound impact on the U.S. economy and society. Such a vulnerability to energy commodities threatens the resilience of the U.S. economy, and therefore, U.S. economic development and growth. To be able to ensure energy security and affordable energy sources, the (joint) dynamics of energy commodity prices should be captured. This article examines the complex dynamic relationship between U.S. crude oil and natural gas prices, as strategic energy sources. While crude oil prices lead natural gas prices, the relationship exhibits regime shifts that depend on technological, economic, and geopolitical factors. In each regime, we model the relationship between crude oil and natural gas price changes by using a linear Kalman filter with stochastic regression coefficients and heteroskedastic errors in the measurement equation. The random parameters and volatility illustrate the uncertainty in energy costs and prices and handle local nonlinearity. Crude oil and natural gas prices decouple for two regimes of about four and five years (i.e., short-term decoupling), while they couple for four subsequent regimes (i.e., long-term coupling for about seventeen years). The results unveil changes in the competition between oil price makers and takers and the impact of technological improvements, including the shale gas revolution and renewable energy. They also provide insights into possible short- and/or long-term hedging strategies between crude oil and natural gas, both at the producer and the end-user level. In this context, the findings are useful for the interplay between the U.S. economy, and both crude oil and natural gas. They provide an opportunity for policymakers to act and strengthen the economic resilience by sustaining energy supply and security, and mitigating energy price risk.

Similar content being viewed by others

Notes

Petroleum and natural gas account for 72% of the total U.S. energy consumption in 2022.

The price of each commodity must be forecast separately.

At least from 2007 to 2016, just before the start of U.S. LNG exports.

The domestic factors consist of supply and demand, regulation, the natural gas liquids markets and recent LNG exports.

Refer to https://www.eia.gov/ for more information.

The Anderson–Darling test is a goodness-of-fit test that allows to test for the hypothesis that a sample random variable follows a theoretical probability distribution. It has several advantages since it is highly sensitive to the tails of the distribution and less sensitive to outliers, it is more flexible because the critical values depend on the theoretical distribution being tested (Anderson and Darling, 1954; D'Agostino & Stephens, 1986).

The Phillips-Perron unit root test is robust to serial correlation and heteroskedasticity in the error term of the associated regression equation. In addition, unlike the Augmented Dickey-Füller (ADF) test, it does not need to specify the number of lags in the regression (Phillips and Perron, 1988).

Incidentally, the natural gas price spike, shown in Fig. 4 on February 25, 2003 was investigated by the Federal Energy Regulatory Commission (FERC) in collaboration with the Commodity Futures Trading Commission (CFTC). However, no market manipulation was evidenced (see FERC Report, 2003). At the time, the physical natural gas market offered a very weak supply that was unable to meet the large level of demand in the U.S. in the short term. Extreme weather conditions (i.e., cold front and winter weather) both supported a sharp increase in the natural gas demand and provoked a disruption of natural gas production due to well freeze-offs. The resulting limited ability of the natural gas industry to respond to a sudden increase in demand, coupled with a low level of storage inventories worsened the supply and demand imbalances, triggering therefore a huge natural gas price spike. Similarly, a natural gas price spike also occurs on February 17, 2021, following a winter storm that triggered an increase in energy demand coupled with a disruption in natural gas production because of well freeze-offs. Finally, the negative crude oil price on April 20, 2020 results from a demand shock as a combination of the covid-19 lockdown and related economic slowdown (i.e., oversupply).

We ran the same tests on the ratio of log-prices, and its adapted version in the regression of crude oil prices on natural gas prices in the presence of cointegration. We found the same number of breaks and very close break dates (when they were not similar).

OPEC stands for the Organization of the Petroleum Exporting Countries.

An AO affects a single point in a series whereas an IO supports a gradual shift in the mean of the series. Sometimes outliers can generate a temporary change such that one observation is extreme and the following observations gradually reduce the magnitude of the outlier’s deviation. In other cases, outliers generate a shift in the level of the series.

We have tested for a local linear trend, but the slope turns out to be insignificant. We also specify a general cycle component, which can be expanded to account for seasonal patterns (i.e., periodic patterns with integer periods).

When a2 is zero, the heteroscedastic variance reduces to an ARCH(1) dynamics.

The duration/period of the cycle is \(2\pi /\lambda _{c})\).

The linear regression uses Heteroskedasticity and Autocorrelation Consistent covariance (HAC) estimates and pre-whitening of residuals with automatic lag selection (Hannan-Quinn criterion). HAC estimates are robust to heteroskedasticity (i.e., robust standard errors; Newey and West, 1987). The pre-whitening methodology reduces data autocorrelation and hence estimation bias (Andrews and Monahan, 1992; Newey and West, 1994).

According to the EIA, the spare capacity is the “volume of production that can be brought on within 30 days and sustained for at least 90 days”.

OPEC members are expected to compensate for non-OPEC production insufficiencies due to their limited production capacity. This scenario is known as the “call on OPEC” (refer to EIA website).

References

Aloui, R., Aïssa, M. S. B., Hammoudeh, S., & Nguyen, D. K. (2014). Dependence and extreme dependence of crude oil and natural gas prices with applications to risk management. Energy Economics, 42, 332–342.

Anderson, T. W., & Darling, D. A. (1954). A test of goodness of fit. Journal of the American Statistical Association, 49(268), 765–769.

Andrews, D. W. K., & Monahan, J. C. (1992). An improved heteroskedasticity and autocorrelation consistent covariance matrix estimator. Econometrica, 60(4), 953–966.

Asche, F., Osmundsen, P., & Sandsmark, M. (2006). The UK market for natural gas, oil and electricity: Are the prices decoupled? Energy Journal, 27(2), 27–40.

Atil, A., Lahiani, A., & Nguyen, D. K. (2014). Asymmetric and nonlinear pass-through of crude oil prices to gasoline and natural gas prices. Energy Policy, 65, 567–573.

Bai, J., & Perron, P. (1998). Estimating and testing linear models with multiple structural changes. Econometrica, 66, 47–78.

Bai, J., & Perron, P. (2003a). Computation and analysis of multiple structural change models. Journal of Applied Econometrics, 6, 72–78.

Bai, J., & Perron, P. (2003b). Critical values for multiple structural change tests. Econometrics Journal, 18, 1–22.

Batten, J. A., Ciner, C., & Lucey, B. M. (2017). The dynamic linkages between crude oil and natural gas markets. Energy Economics, 62, 155–170.

Bauwens, L., Lubrano, M., & Richard, J.-F. (1999). Bayesian inference in dynamic econometric models. Oxford University Press.

Berk, I., & Rauch, J. (2016). Regulatory interventions in the US oil and gas sector: How do the stock markets perceive the CFTC’s announcements during the 2008 financial crisis? Energy Economics, 54, 337–348.

Brigida, M. (2014). The switching relationship between natural gas and crude oil prices. Energy Economics, 43, 48–55.

Brown, S.P.A. (2005). Natural gas pricing: Do oil prices still matter? Federal Reserve Bank of Dallas. Southwest Economy, USA, pp. 9–11.

Brown, M. B., & Forsythe, A. B. (1974). Robust test for the equality of variances. Journal of the American Statistical Association, 69(346), 364–367.

Brown, S. P. A., & Yücel, M. K. (2008). What drives natural gas prices? Energy Journal, 29(2), 45–60.

Bunn, D., Chevallier, J., Pen, Y. L., & Sevi, B. (2017). Fundamental and financial influences on the co-movement of oil and gas prices. Energy Journal, 38(2), 201–228.

Caporin, M., & Fontini, F. (2017). The long-run oil–natural gas price relationship and the shale gas revolution. Energy Economics, 64, 511–519.

Creamer, G. G., & Creamer, B. (2016). A nonlinear lead lag dependence analysis of energy futures: Oil, coal and natural gas. In I. Florescu, M. C. Mariani, & H. E. Stanley (Eds.), Handbook of high-frequency trading and modelling in finance (pp. 61–72). Wiley.

D’Agostino, R. B., & Stephens, M. A. (1986). Goodness of fit techniques. Marcel Dekker.

Da, Z., Tang, K., Tao, Y., & Yang, L. (2024). Financialization and commodity markets serial dependence. Management Science, 70(4), 2122–2143.

Dahl, R. E., Oglend, A., Osmundsen, P., & Sikveland, M. (2012). Are oil and natural gas going separate ways in the United Kingdom? Cointegration tests with structural shifts. Journal of Energy Markets, 5(2), 33–58.

Durbin, J., & Koopman, S. J. (2012). Time series analysis by state space methods (2nd ed.). Oxford: Oxford University Press.

EIA (U.S. Energy Information Administration) (2016). Trends in U.S. oil and natural gas upstream costs. U.S. Department of Energy report, Independent Statistics & Analysis (2016).

Engle, R. (2001). GARCH 101: The use of ARCH/GARCH models in applied econometrics. Journal of Economic Perspectives, 15(4), 157–168.

Fan, Y., & Xu, J.-H. (2011). What has driven oil prices since 2000? A Structural Change Perspective. Energy Economics, 33(6), 1082–1094.

Feng, G.-F., Wang, Q.-J., Chu, Y., Wen, J., & Chang, C.-P. (2021). Does the shale gas boom change the natural gas price-production relationship? Evidence from the U.S. market. Energy Economics, 93, 104327.

FERC (Federal Energy Regulatory Commission) Staff Investigating Team (2003). Report of the natural gas price spike of february 2003. Federal Energy Regulatory Commission (FERC) Report, July 23, 2003.

FERC (2007). 2006 state of the market report. Federal Energy Regulatory Commission, (FERC) Report, February 2007.

Fisher, T. J., & Gallagher, C. M. (2012). New weighted Portmanteau statistics for time series goodness of fit testing. Journal of the American Statistical Association, 107(498), 777–798.

Fong, W. M., & See, K. H. (2002). A Markov switching model of the conditional volatility of crude oil futures prices. Energy Economics, 24(1), 71–95.

Ftiti, Z., Tissaoui, K., & Boubaker, S. (2022). On the relationship between oil and gas markets: A new forecasting framework based on a machine learning approach. Annals Operations Research, 313, 915–943.

Gatfaoui, H. (2015). Pricing the (European) option to switch between two energy sources: An application to crude oil and natural gas. Energy Policy, 87, 270–283.

Gatfaoui, H. (2016). Linking the gas and oil markets with the stock market: Investigating the U.S. relationship. Energy Economics, 53, 5–16.

Gatfaoui, H. (2019). Diversifying portfolios of U.S. stocks with crude oil and natural gas: A regime-dependent optimization with several risk measures. Energy Economics, 80, 132–152.

Gong, X., Liu, Y., & Wang, X. (2021). Dynamic volatility spillovers across oil and natural gas futures markets based on a time-varying spillover method. International Review of Financial Analysis, 76, 101790.

Gupta, M., Gao, J., Aggarwal, C. C., & Han, J. (2013). Outlier detection for temporal data. The 13th SIAM International Conference on Data Mining (SDM 13), Austin, Texas.

Hansen, P. V., & Lindholt, L. (2008). The market power of OPEC: 1973–2001. Applied Economics, 40(22), 2939–2959.

Hartley, P. R., Medlock, K. B., III., & Rosthal, J. E. (2008). The relationship of natural gas to oil prices. Energy Journal, 29(3), 47–65.

Harvey, A. C. (1989). Forecasting, structural time series models, and the Kalman filter. Cambridge University Press.

Harvey, A. C., & Koopman, S. J. (2009). Unobserved component models in economics and finance. IEEE Control Systems Magazine, December, 71–81.

Hasanli, M. (2024). Re-examining crude oil and natural gas price relationship: Evidence from time-varying regime-switching models. Energy Economics, 133, 107510.

Hooker, M. A. (2002). Are oil shocks inflationary? Asymmetric and nonlinear specifications versus changes in regime. Journal of Money Credit and Banking, 34(2), 540–561.

Hu, H., Wei, W., & Chang, C.-P. (2020). The relationship between shale gas production and natural gas prices: An environmental investigation using structural breaks. Science of the Total Environment, 713, 136545.

Huntington, H. G. (2007). Industrial natural gas consumption in the United States: An empirical model for evaluating future trends. Energy Economics, 28(4), 743–759.

Huppmann, D., & Holz, F. (2012). Crude oil market power: A shift in recent years? Energy Journal, 33(4), 1–22.

Jadidzadeh, A., & Serletis, A. (2017). How does the U.S. natural gas market react to demand and supply shocks in the crude oil market? Energy Economics, 63, 66–74.

Ji, Q., Zhang, H.-Y., & Geng, J.-B. (2018). What drives natural gas prices in the United States?: A directed acyclic graph approach. Energy Economics, 69, 79–88.

Joëts, M. (2015). Heterogeneous beliefs, regret, and uncertainty: The role of speculation in energy price dynamics. European Journal of Operational Research, 247(1), 204–215.

de Jong, P. (1991). The diffuse Kalman filter. Annals of Statistics, 19(2), 1073–1083.

de Jong, P., & Chu-Chun-Lin, S. (1994). Fast likelihood evaluation and prediction for non-stationary state space model. Biometrika, 81(1), 133–142.

de Jong, P., & Chu-Chun-Lin, S. (2003). Smoothing with an unknown initial condition. Journal of Time Series Analysis, 24, 141–148.

de Jong, P., & Penzer, J. (1998). Diagnosing shocks in time series. Journal of the American Statistical Association, 93, 796–806.

Kang, W., Tang, K., & Wang, N. (2023). Financialization of commodity markets ten years later. Journal of Commodity Markets, 30, 100313.

Kilian, L. (2008a). A Comparison of the effects of exogenous oil supply shocks on output and inflation in the G7countries. Journal of the European Economic Association, 6(1), 78–121.

Kilian, L. (2008b). The economic effects of energy price shocks. Journal of Economic Literature, 46(4), 871–909.

Kilian, L. (2014). Energy price shocks. Working Paper, CEPR, University of Michigan.

Kilian, L., & Murphy, D. P. (2014). The role of inventories and speculative trading in the global market for crude oil. Journal of Applied Econometrics, 29(3), 454–478.

Kim, C.-J., & Nelson, C. R. (1999). State-space models with regime switching: classical and gibbs-sampling approaches with applications. MIT Press.

Labys, W. (2006). Modeling and forecasting primary commodity prices. Ashgate Publishing.

Levene, H. (1960). Robust tests for equality of variances. In I. Olkin, S. G. Ghurye, W. Hoeffding, W. G. Madow, & H. B. Mann (Eds.), Contributions to probability and statistics: Essays in honor of Harold Hotelling (pp. 278–292). Stanford University Press.

Li, W. K., & Mak, T. K. (1994). On the squared residual autocorrelations in non-linear time series with conditional heteroskedasticity. Journal of Time Series Analysis, 15(6), 627–636.

Li, L. G., Zhang, P. Y., Tan, J. T., & Guan, H. M. (2019). Review on the evolution of resilience concept and research progress on regional economic resilience. Human Geography, 34, 1–7.

Liu, L., & Zhang, X. (2019). Financialization and commodity excess spillovers. International Review of Economics & Finance, 64, 195–216.

Martin, R., & Sunley, P. (2015). On the notion of regional economic resilience: Conceptualization and explanation. Journal of Economic Geography, 15, 1–42.

Martin, R., Sunley, P., & Tyler, P. (2015). How regions react to recessions: Resilience and the role of economic structure. Regional Studies, 50, 561–585.

McLeod, A. I., & Li, W. K. (1983). Diagnostic checking ARMA time series models using squared-residual autocorrelations. Journal of Time Series Analysis, 4(4), 269–273.

Mensi, W., Rehman, M. U., & Vo, X. V. (2021). Dynamic frequency relationships and volatility spillovers in natural gas, crude oil, gas oil, gasoline, and heating oil markets: Implications for portfolio management. Resources Policy, 73(2), 102172.

Müller, J., Hirsch, G., & Müller, A. (2015). Modelling the price of natural gas with temperature and oil price as exogenous factors. In: Glau, K., Scherer, M., Zagst, R.(Eds.), Innovations in Quantitative Risk Management, Springer Proceedings in Mathematics & Statistics 99. Springer International Publishing, pp. 109–128.

Muštra, V., Šimundić, B., & Kuliš, Z. (2017). Effects of smart specialization on regional economic resilience in EU. Revista De Estudios Regionales, 110, 175–195.

Neter, J., Kutner, M. H., Nachtsheim, C. J., & Wasserman, W. (1996). Applied linear statistical models (4th ed.). Times Mirror Higher Education Group, Inc. and Richard D. Irwin Inc.

Newey, W. K., & West, K. D. (1987). A Simple positive semi-definite, heteroskedasticity and autocorrelation consistent covariance matrix. Econometrica, 55(3), 703–708.

Newey, W. K., & West, K. D. (1994). Automatic lag length selection in covariance matrix estimation. Review of Economic Studies, 61(4), 631–653.

Nguyen, D. K., Sensoy, A., Sousa, R. M., & Uddin, G. S. (2020). US equity and commodity futures markets: Hedging or financialization? Energy Economics, 86, 104660.

Nomikos, N. K., & Pouliasis, P. K. (2011). Forecasting petroleum futures markets volatility: The role of regimes and market conditions. Energy Economics, 33(2), 321–337.

Okhrin, Y., Uddin, G. S., & Yahya, M. (2023). Nonlinear and asymmetric interconnectedness of crude oil with financial and commodity markets. Energy Economics, 125, 106853.

Oskullo, S. J., & Reynès, F. (2016). Imperfect cartelization in OPEC. Energy Economics, 60, 333–344.

Perifanis, T., & Dagoumas, A. (2019). Living in an era when market fundamentals determine crude oil price. Energy Journal, 40(1), 317–336.

Perron, P. (1989). The great crash, the oil price shock, and the unit root hypothesis. Econometrica, 57, 1361–1401.

Perron, P. (1997). Further evidence on breaking trend functions in macroeconomic variables. Journal of Econometrics, 80, 355–385.

Perron, P. (2006). Dealing with structural breaks. In T. C. Mills & K. Patterson (Eds.), Palgrave Handbook of Econometrics, Econometric Theory. (Vol. 1). New York: Palgrave Macmillan.

Phillips, P. C. B., & Perron, P. (1988). Testing for a unit root in time series regression. Biometrika, 75(2), 335–346.

Ramberg, D. J., & Parsons, J. E. (2012). The weak tie between natural gas and oil prices. Energy Journal, 33(2), 13–35.

Rehman, M. U., Bouri, E., Eraslan, V., & Kumar, S. (2019). Energy and non-energy commodities: An asymmetric approach towards portfolio diversification in the commodity market. Resources Policy, 63, 101456.

Rizvi, S. K. A., Naqvi, B., Boubaker, S., & Mirza, N. (2022). The power play of natural gas and crude oil in the move towards the financialization of the energy market. Energy Economics, 112, 106131.

Salisu, A. A., & Fasanya, I. O. (2012). Comparative performance of volatility models for oil price. International Journal of Energy Economics and Policy, 2(3), 167–183.

Scarcioffolo, A. R., & Etienne, X. (2021). Testing directional predictability between energy prices: A quantile-based analysis. Resources Policy, 74, 102258.

Sensier, M., Bristow, G., & Healy, A. (2016). Measuring regional economic resilience across Europe: Operationalizing a complex concept. Spatial Economic Analysis, 11, 128–151.

Šťastná, S., Ženka, J., & Krtička, L. (2024). Regional economic resilience: Insights from five crises. European Planning Studies, 32(3), 506–533.

Sutton, J., & Sutton, J. (2024). A road map to capture the spatial dependence underlying regions’ economic resilience. Spatial Economic Analysis, 19(1), 57–72.

Tiwari, A. K., Mukherjee, Z., Gupta, R., & Balcilar, M. (2019). A wavelet analysis of the relationship between oil and natural gas prices. Resources Policy, 60, 118–124.

Uribe, J. M., Mosquera-López, S., & Arenas, O. J. (2022). Assessing the relationship between electricity and natural gas prices in European markets in times of distress. Energy Policy, 166, 113018.

U.S. Energy Information Administration (EIA) (2012). Fuel competition in power generation and elasticities of substitution. U.S. Department of Energy Report, Washington.

Villar, J.A., & Joutz, F.L. (2006). The relationship between crude oil and natural gas prices. Working Paper, George Washington University.

Vo, M. T. (2009). Regime-switching stochastic volatility: Evidence from the crude oil market. Energy Economics, 31(5), 779–788.

Wang, T., Zhang, D., & Broadstock, D. C. (2019). Financialization, fundamentals, and the time-varying determinants of US natural gas prices. Energy Economics, 80, 707–719.

Weare, C. (2003). The California electricity crisis: Causes and policy options. Public Policy Institute of California.

Zhang, D., & Ji, Q. (2018). Further evidence on the debate of oil-gas price decoupling: A long memory approach. Energy Policy, 113, 68–75.

Zivot, E., & Andrews, D. W. K. (1992). Further evidence on the great crash, the oil-price shock, and the unit-root hypothesis. Journal of Business and Economic Statistics, 10, 251–270.

Acknowledgements

We thank two anonymous referees for their questions and comments. We also thank the participants of the 67th EWGCFM (Rome, May 2023) and Hélyette Geman for their interesting questions and remarks. The usual disclaimer applies.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The author has no relevant financial or non-financial interests to disclose, and no competing interests to declare that are relevant to the content of this article.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

1.1 Current natural gas and lagged crude oil price changes

To examine the relationship between crude oil and natural gas price changes, we consider the cross correlations between their price changes up to 5 leads/lags in each regime. Unreported results show that the cross-correlation between DGast and DOilt-1 is the strongest (i.e., stronger relationship between current natural gas price changes and previous crude oil price changes at lag 1). We confirm this finding by running linear regressions of DGast against DOilt-1 in each regime, using HAC estimates (see Table

10).

Indeed, the absolute value of slope coefficient b and the R2 of regressions are larger when the independent variable is the previous crude oil price changes. Therefore, the strongest relationship should be studied when examining the link between DGast and DOilt-1 in each regime.

Furthermore, a brief comparison of the cross-correlation between natural gas and crude oil price changes at lags 0 and 1 supports the previous link (see Table

11).

1.2 Testing for structural changes

Assume that there is a maximum number of N possible breaks with corresponding break dates (t1 < … < ti < … < tN), and that all the time series have a size of T. Let us set t0 = 1 as the first observation and tN+1 = T the last observation of the sample (i.e., the start and end dates of the sample). The N possible breaks determine (N + 1) regimes that occur at time intervals I1 = [t0, t1] for regime 1, and Ii+1 =]ti,ti+1] for any regime (i + 1) with i \(\in\) {2,…,N}. The test examines the break dates by considering the following regression with regime-specific coefficients (i.e., pure structural change model):

where i is the regime, t \(\in\) Ii for i \(\in\) {1,…,N + 1}, \({\alpha }_{i}\) is the regime-specific constant, \({\beta }_{i}\) is the regime-specific slope, and \({\varepsilon }_{i,t}\) is the regime-specific residual that follows a Gaussian probability distribution with a zero mean and a constant standard deviation \({\sigma }_{i}\).

Bai and Perron (1998) test for the equality of \({\alpha }_{i}\) coefficients on the one hand, and \({\beta }_{i}\) coefficients across the different possible regimes on the other hand (i.e., H0: \({\alpha }_{0}\)=… = \({\alpha }_{i}\)=…=\({\alpha }_{N}\) and \({\beta }_{0}\)=… = \({\beta }_{i}\)=… = \({\beta }_{N}\)). In the presence of multiple unknown breaks, a version of the test sequentially tests for the null hypothesis of l breaks versus no break for l \(\in\) {1,…,N} (i.e., when the constancy of parameters is rejected). Such an approach consists of starting with an unknown break date and detecting whether the regression coefficients move across any set of two sub-samples that can be built from the entire sample (i.e., detecting when parameter constancy is rejected). A second break date is then added to investigate the stability of coefficients across the further sub-samples that can be built (i.e., alternatively testing for the existence of l = 2 breaks versus one break). The process is repeated until the maximum number of breaks N is reached or until no more breaks can be detected (i.e., the null is not rejected). The test is based on minimising the sum of squared residuals across the listed regimes (i.e., ordinary least squares estimation). The null is tested by using a \(\text{sup}F\) statistic, which is scaled when several regression coefficients are regime-dependent (Bai & Perron, 1998, 2003a, 2003b). If the statistic is larger than its critical value at 5% for a given number of breaks, the constancy of regression parameters across the detected regimes is rejected, and the identified number of breaks and related break dates are statistically significant.

1.3 Unobserved component model with heteroskedastic errors

First, Eqs. (2), (4), (5), (7), and (8) can be summarized in a general multivariate setting as follows (see Kim & Nelson, 1999):

where

\(v_{t}^{*} \sim N\left( {0_{5} ,Q_{t}^{*} } \right)\) with \(0_{5} = \left( {\begin{array}{*{20}c} {\begin{array}{*{20}c} 0 \\ 0 \\ 0 \\ \end{array} } \\ {\begin{array}{*{20}c} 0 \\ 0 \\ \end{array} } \\ \end{array} } \right)\) and \( Q_{t}^{*} = E\left[ {\left. {v_{t}^{*} v_{t}^{*{\prime}} } \right|{\mathcal{F}}_{t - 1} } \right] = \left( {\begin{array}{*{20}c} {\begin{array}{*{20}c} {\sigma_{0}^{2} } & 0 & 0 \\ 0 & {\sigma_{1}^{2} } & 0 \\ 0 & 0 & {\sigma_{2}^{2} } \\ \end{array} } & {\begin{array}{*{20}c} 0 & 0 \\ 0 & 0 \\ 0 & 0 \\ \end{array} } \\ {\begin{array}{*{20}c} {0 } & {0 } & 0 \\ {0 } & {0 } & 0 \\ \end{array} } & {\begin{array}{*{20}c} {\sigma_{2}^{2} } & 0 \\ 0 & {h_{t} } \\ \end{array} } \\ \end{array} } \right)\).

Let’s now introduce some conditional expectations and variances and other necessary computations, where the symbosl \(\boldsymbol{^{\prime}}\) denotes the transposition operator:

-

The Expected value of \({\beta }_{t}^{*}\) conditional on the information set available up to (t-1) writes as \({\beta }_{\left.t\right|t-1}^{*}={F}^{*}{\beta }_{\left.t-1\right|t-1}^{*}\)

-

The Covariance matrix of \({\beta }_{t}^{*}\) conditional on the information set available up to (t-1) writes as \({P}_{\left.t\right|t-1}^{*}={F}^{*}{P}_{\left.t-1\right|t-1}^{*}{F}^{*{\prime}}+{Q}_{t}^{*}\)

-

The Prediction error writes as \({\eta }_{\left.t\right|t-1}^{*}={y}_{t}-{{X}_{t-1}^{*}\beta }_{\left.t\right|t-1}^{*}\)

-

The Conditional variance of the prediction error writes as \({f}_{\left.t\right|t-1}^{*}={X}_{t-1}^{*}{P}_{\left.t-1\right|t-1}^{*}{X}_{t-1}^{*{\prime}}\)

-

The Expected value of \({\beta }_{t}^{*}\) conditional on the information set available up to time (t) writes as \({\beta }_{\left.t\right|t}^{*}={\beta }_{\left.t\right|t-1}^{*}+{P}_{\left.t\right|t-1}^{*}{X}_{t-1}^{*{\prime}}{f}_{\left.t\right|t-1}^{*-1}{\eta }_{\left.t\right|t-1}^{*}\)

-

The Covariance matrix of \({\beta }_{t}^{*}\) conditional on the information set available up to (t) writes as \({P}_{\left.t\right|t}^{*}={P}_{\left.t\right|t-1}^{*}-{P}_{\left.t\right|t-1}^{*}{X}_{t-1}^{*{\prime}}{f}_{\left.t\right|t-1}^{*-1}{X}_{t-1}^{*}{P}_{\left.t\right|t-1}^{*}\)

The log-likelihood function (ln L) to be maximized then writes:

where T is the sample size.

For regimes 2 and 6, Eqs. (3), (4), (5), (7), and (8) can be summarized in a general multivariate setting as follows (i.e., endogenous trend and periodic components, and an additional exogenous component):

where all notations and definitions remain the same as above except for the prediction error which writes now as \({\eta }_{\left.t\right|t-1}^{*}={y}_{t}-{{X}_{t-1}^{*}\beta }_{\left.t\right|t-1}^{*}-\) \({d}\,\,{Dummy}_{t}\). The log-likelihood function (ln L) to be maximized is still expressed as in Eq. (16). Note that, when a cyclical component is included in the measurement Eqs. (2) and (3), the corresponding period estimate is 6 months.

1.4 Summary of the data analysis and econometric study

The Table 12 below summarises the various tests and econometric models carried out on the data sample. As the data exhibit structural breaks and therefore regime shifts, the econometric model is estimated in each regime.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Gatfaoui, H. On the relationship between U.S. crude oil and natural gas for economic resilience prospects. Ann Oper Res (2024). https://doi.org/10.1007/s10479-024-06411-9

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s10479-024-06411-9